In this blog post, we delve into the world of lumber prices, exploring the factors influencing their fluctuations, their impact on trading economics, and the implications for businesses and consumers.

Lumber is a vital commodity in the construction and housing industries, and its prices play a significant role in the overall economy.

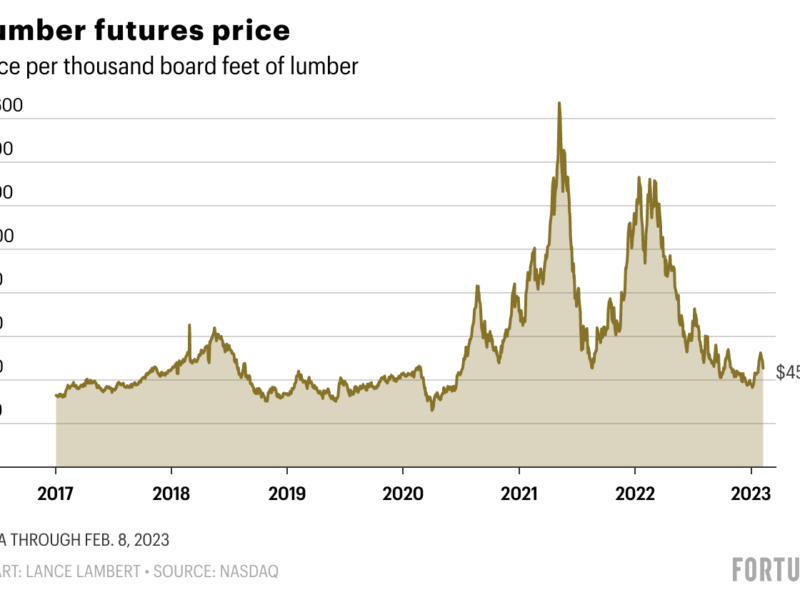

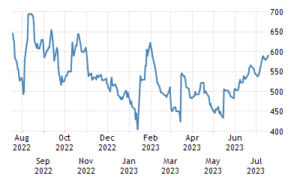

Over the past few years, lumber prices have experienced substantial volatility, impacting various sectors and consumer wallets.

By understanding the dynamics of lumber prices, we can gain insights into broader economic trends and make informed decisions in response to market changes.

Supply and Demand Factors

Lumber prices are primarily influenced by supply and demand dynamics. Factors such as housing starts, renovation activities, and the overall health of the construction industry play a significant role in determining demand for lumber.

When construction and housing markets are robust, demand for lumber increases, driving prices higher. Conversely, during economic downturns or periods of decreased construction activity, demand may decline, leading to lower lumber prices.

Supply factors also impact lumber prices. Natural disasters, such as wildfires or hurricanes, can disrupt timber supply, reducing the availability of lumber and causing prices to rise. Additionally, trade policies, transportation costs, and regulations impacting logging and timber production can affect the supply side of the lumber market.

Market Speculation and Investor Sentiment

Market speculation and investor sentiment can contribute to the volatility of lumber prices. Speculators, including hedge funds and institutional investors, may enter the lumber futures market to capitalize on potential price fluctuations. Their actions can create additional price volatility, especially in times of heightened market uncertainty.

Investor sentiment, influenced by economic indicators, interest rates, and global events, also impacts lumber prices. Positive economic indicators, such as rising housing starts or strong consumer confidence, can drive up investor optimism, leading to increased demand for lumber futures and potentially higher prices.

Conversely, negative economic indicators or global events can dampen investor sentiment, resulting in decreased demand for lumber futures and potential price declines.

Impact on Trading Economics

Lumber prices have a ripple effect on trading economics, influencing various sectors and market participants. Here are some key areas affected:

Construction Industry

Lumber is a critical component in construction projects, including residential and commercial buildings. Fluctuating lumber prices directly impact construction costs, potentially affecting project budgets and profitability. Higher lumber prices can lead to increased construction costs, limiting affordability and potentially slowing down construction activity.

Housing Market

Lumber prices have a significant impact on the housing market. Higher lumber costs can translate into increased home prices, making home ownership less affordable for potential buyers. The availability and affordability of new homes can be influenced by lumber price fluctuations, affecting supply and demand dynamics within the housing market.

Home Improvement and Renovation

Lumber prices also affect the home improvement and renovation industry. Higher lumber costs can increase the expenses associated with remodeling projects, potentially reducing the frequency or scale of such projects. This, in turn, affects related industries like flooring, cabinetry, and furniture manufacturing.

Retail Sector

Retailers that specialize in home improvement, construction supplies, or furniture can experience the impact of lumber price fluctuations. Higher lumber prices may lead to increased costs for retailers, which can be passed on to consumers through higher prices or reduced profit margins.

Strategies for Businesses and Consumers

In response to volatile lumber prices, businesses and consumers can employ various strategies to mitigate the impact:

Monitor Market Trends

Stay informed about lumber price trends by following industry news, market reports, and economic indicators. This knowledge can help businesses and consumers make informed decisions regarding timing and budgeting for construction or home improvement projects.

Seek Alternative Materials

Explore alternative materials or construction methods that may be less impacted by lumber price fluctuations. This can include using engineered wood products or considering modular construction techniques.

Plan Ahead

Businesses involved in construction or manufacturing should consider hedging strategies, such as forward contracts or futures contracts, to lock in lumber prices for future projects. Homeowners planning renovations can take advantage of sales, discounts, or bulk purchasing opportunities during periods of lower lumber prices.

Collaboration and Negotiation

Businesses within the construction supply chain can collaborate and negotiate with suppliers and contractors to find cost-saving solutions and mitigate the impact of higher lumber prices.

Conclusion

Lumber prices have a profound impact on trading economics, influencing construction, housing, and related industries. Understanding the dynamics of lumber prices allows businesses and consumers to navigate market changes more effectively.

By closely monitoring market trends, exploring alternative materials, planning ahead, and collaborating with supply chain partners, stakeholders can mitigate the impact of lumber price fluctuations and make informed decisions. As the lumber market continues to evolve, maintaining awareness of pricing trends and employing appropriate strategies will be essential for successfully navigating this vital economic component.

Next Article: